Why Sports Prediction Markets are Better than Traditional Sports Betting Sites

For years the online gambling and online sports betting industry has been dominated by “bookmakers” looking to take your wager. This traditional and longstanding form of operation has seen its ups and downs over the years but now there is a better way to make predictions and place bets online. That way is in the form of a sports prediction market.

In a sports prediction market shares are always traded between $0.01-$0.99. The price that people are willing to either buy or sell a share, amounts to the probability the market has assigned to the outcome occurring. If the market price for a share (lets say the Los Angeles Lakers beating the Phoenix Suns) stays at $0.68, that means the probability of the Lakers beating the Suns is 68% according to the market.

If the Lakers end up beating the Suns, those holding yes shares will receive $1 per share. Those holding no shares will receive $0.

As mentioned, shares in prediction markets become binary when the outcome of the relevant event is determined. They wind up being worth 0% or 100%. However, at any point, market participants can buy/sell shares at any price between 0 and 100. The value of shares in an event fluctuates over time, as the score during an event constantly changes and shares are bought and sold. What you are willing to buy/sell at will depend on how confident you are in your prediction.

There are many reasons a sports prediction market is better than a traditional sports betting website. For one, you are not betting against “the house”. You are betting against other active live traders at agreed upon odds. This makes the odds prices far more accurate than if you were betting against the house. Nextly, because prediction markets are “exchange-traded markets” that deal in buying/selling of shares, you can literally buy or sell shares at any given moment before or during any event (live or otherwise). Think of it like having a cash out option, but better. An example would be like this:

The New York Knicks are beating the Milwaukee Bucks 22-16 in the first quarter

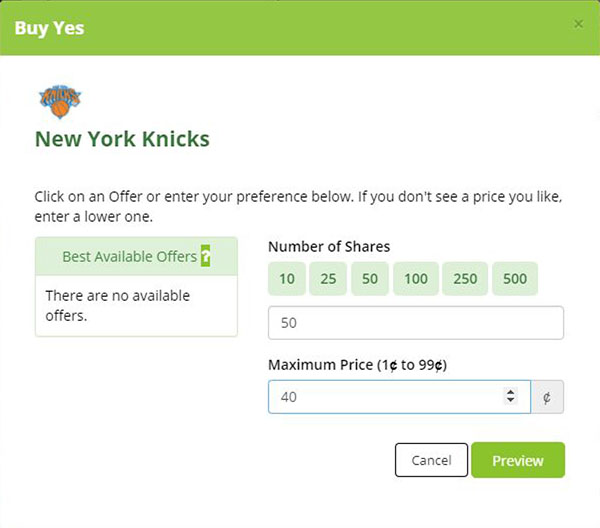

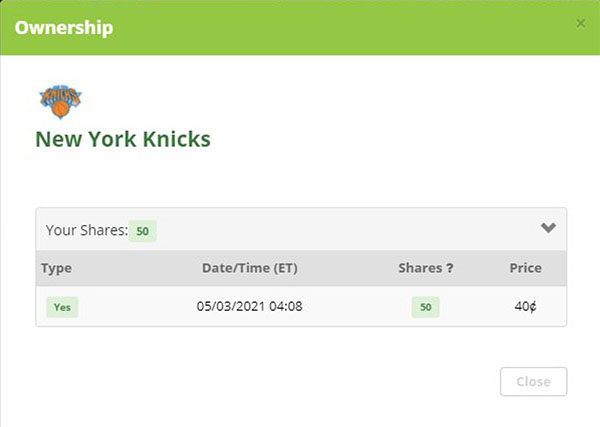

Even though it’s early, Trader A is feeling confident in the Knicks and decides to make a Buy Yes offer on the New York Knicks for 50 shares at .40 cents per share.

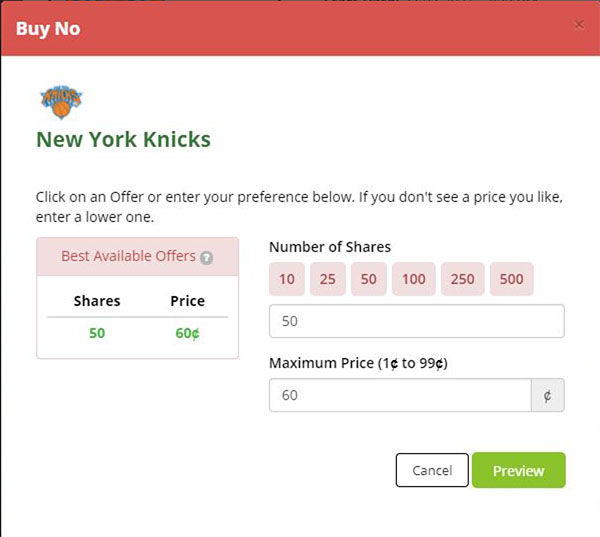

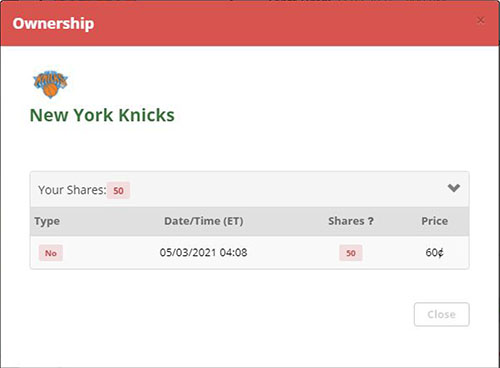

Once that offer is submitted, Trader B comes along and is interested in taking the other side of those odds. Trader B buys 50 shares of Buy No on the New York Knicks winning at .60 per share

At this point, both trader A and trader B have a vested wager in tonight’s game

Trader A currently has 50 shares x .40 = $20 invested

Trader B currently has 50 shares x .60 = $30 invested

Later on in the contest, the New York Knicks go up 84-70 in the 3rd quarter with 1:00 remaining.

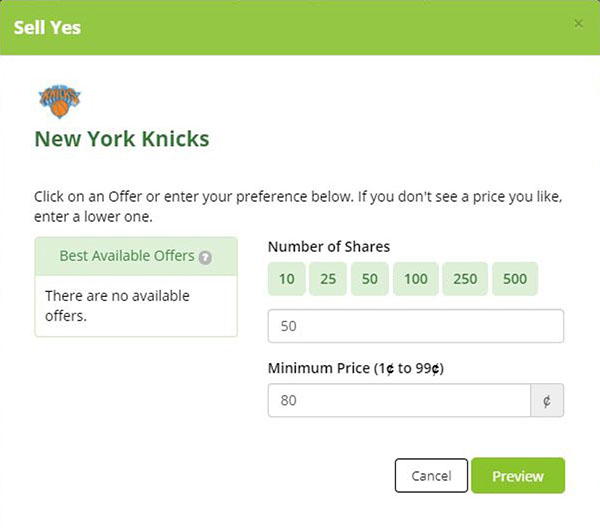

Trader A decides he no longer wants to hold onto his shares until the end of the game and makes a Sell Yes offer for 50 shares at .80 cents per share (implying an 80% chance of winning).

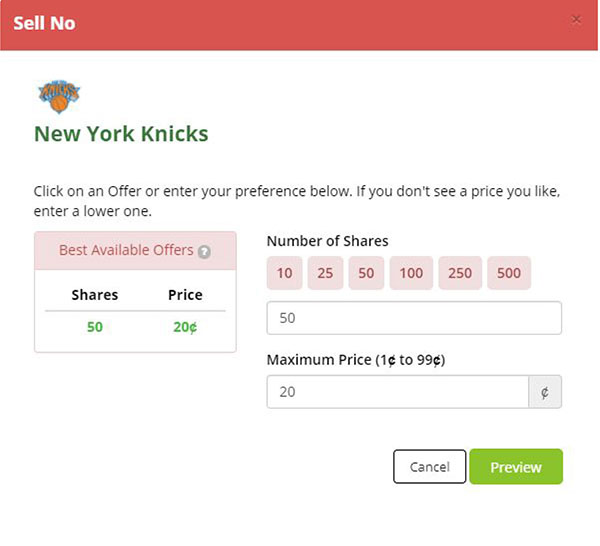

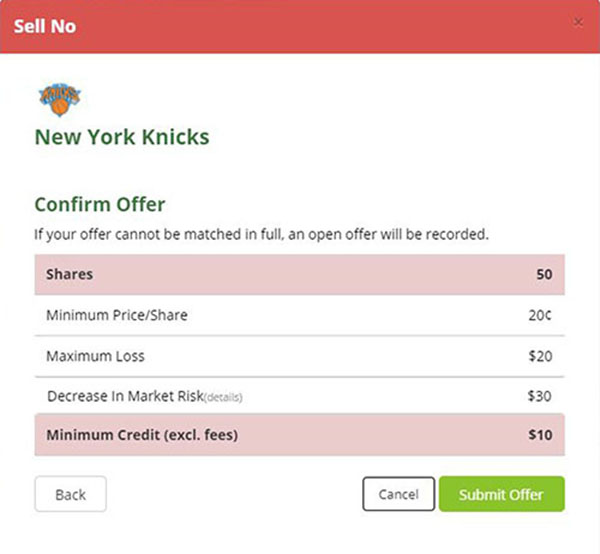

Trader B also decides he would like to exit the trade and sells his 50 shares for $.20 cents per share.

Both Trader A and Trader B have now exited the trade.

Trader A initially had 50 shares for .40 but sold his 50 shares for .80 thus doubling his money and exiting the trade with $40 (profit of $20)

Trader B initially had 50 shares for .60 but sold his 50 shares for .20 thus initially buying in for $30 but exiting the trade with $10 (losing $20)

Trader A and Trader B did not have to sell all 50 of their shares and could’ve just sold a portion, but this is just an example showing the dynamic trading effects of a live sports prediction market.

With more traders and lots of price action, sports prediction markets can produce extremely accurate pricing odds and a one-of-a-kind exciting new way to bet the swings of a live sporting event.

The key to making money in sports prediction markets is knowing when to “buy low, and sell high!” Investors in prediction markets make money when they believe that there’s room in share prices to make money (i.e. if the likelihood that an event will occur is underpriced).

How do you do this successfully? Well, that’s the tricky part. If you believe there’s a discrepancy between the probability reflected in the share price and the actual probability of it occurring, bet on it!

What makes SportsSwaps different from every other sports betting website out there is that it allows the bettors themselves to determine fair market value and correct pricing of odds. No longer do sports bettors have to be boxed in to bet the odds provided by traditional sportsbooks. Now sports gamblers can determine their own odds and maximize their profits by buying/selling shares at any time and at any price they want!

One user of the political prediction market predictit.org said it best when he described it like this:

“It's a bummer that the FEDS continue to protect an inefficient, brick-and-mortar system. Sports prediction markets would absolutely thrive and have more correct odds than sports books currently offer. Think of a simple event like who would be the next NCAA basketball champion. The fact that bettors cannot buy low and sell high at any time before the event is ridiculous. The lack of arbitrage and true market dynamics produces a slow, inaccurate price. The moneyline tends to be pretty good and fluid, but a dynamic prediction market would offer an even more accurate odds and point spreads. Plus there would be so many fascinating prop bets that I'd love to know the odds of. Existing regulation continues to protect the Vegas sportsbooks, who want sports betting illegal. The model is ripe for disruption.”

Overall, sports prediction markets are definitely a more thrilling, exciting, profitable, and interactive way to bet on sports. With SportsSwaps, you will be able to have more freedom and fun in your betting experience then you would’ve thought imaginable prior. Give SportsSwaps a shot today and you will not be dissapointed.